Foreign Property News | Posted by Si Thu Aung

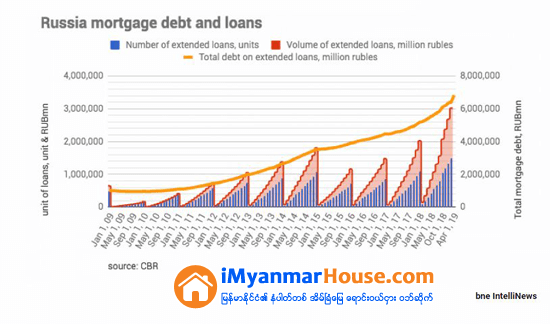

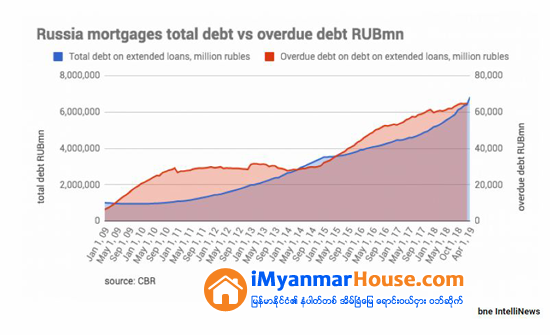

The Central Bank of Russia (CBR) is worried about a growing housing bubble and will act to cool the mortgage market, but market participants think the regulator is being overly cautious.

The CBR published a warning to banks saying that the growing number of loans could be causing real estate prices to rise, which causes a feedback loop that will send prices up and encourage borrowing.

Consumer debt has been ballooning in general in the last two years as Russians turn to bank loans to maintain their lifestyle in the face of stagnant real income growth. More worryingly, punters are also taking loans to refinance their old debt.

As bne IntelliNews has reported, Russia’s real estate market is coming back to life and the residential sector is increasingly driven by mortgage loans, which have risen from nothing to about two-thirds for funding purchases.

The Kremlin has been actively encouraging the growth of mortgage lending.

Until last year the government was subsidising mortgages while the average rate on a loan was over 12 percent, but after the average fell below that rate the subsidies stopped.

Earlier this year average rates on home loans dropped below 10 percent and in March President Vladimir Putin called on banks to bring rates to below 8 percent.

The CBR has once again bolstered its credentials as one of the most conservative and orthodox in the world and is actively trying to cool all this consumer lending activity, although analysts quoted by Vedomosti said the regulator may be over cautious.

Ref: Property Report