Foreign Property News | Posted by Zarni Kyaw

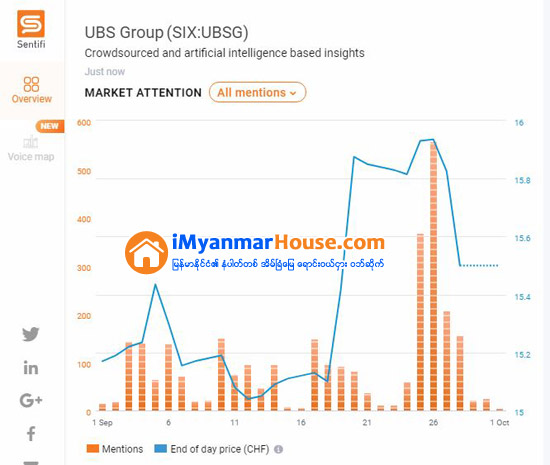

City’s residential prices have risen by more than 10 per cent over the past four quarters and UBS predicts these booming prices will slow in near future.

Hong Kong remains the world’s most overvalued housing market and is at the greatest risk of a property bubble, according to UBS Global Wealth Management on Thursday.

Besides Hong Kong, property values over the past year also soared in Munich, Toronto, Vancouver, London and Amsterdam, according to UBS’s Global Real Estate Bubble Index 2018.

Toronto and London remained at risk of a property bubble, even as their real estate prices have softened in the last year, the report said.

The study found price overvaluation in most major financial centres, with Chicago standing alone as the only undervalued city among the 20 ranked in the survey.

Unlike the period leading up to the 2008 global financial crisis, there is little evidence of excesses in lending and construction, while mortgage volumes are growing at only half the rate.

“Although many financial centres remain at risk of a housing bubble, we should not compare today’s situation with pre-crisis conditions,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. “Nevertheless, investors should remain selective within housing markets in bubble risk territory such as Hong Kong, Toronto and London.”

UBS said cities that rated as being in bubble risk territory where at “an elevated risk of a large price correction”.

Price bubbles are also notoriously hard to identify, as “a non-ambiguous identification is only possible after the bubble bursts,” the bank said.

In Hong Kong residential prices have risen by more than 10 per cent over the past four quarters, in inflation-adjusted terms. Affordability in Hong Kong has deteriorated more than in any other major city during the past decade, as demand remains high in an undersupplied market.

UBS predicted the city’s booming prices to slow in the near future, but said a sharp price correction is unlikely.

Elsewhere in Asia, Singapore was one of the few cities where affordability has improved over the past decade. After six years of correction prices rose 9 per cent over the last four quarters, but the Lion City is still considered as a “fair valued territory”.

Boston and Milan were also noted as fairly valued, while Stockholm remained at risk even as prices have slipped 7 per cent since the middle of last year. Sydney was another market at risk

Ref : Property Report