Foreign Property News | Posted by Hnin Ei Khin

Home sales are hurting. Even with lower mortgages rates and a sales pick-up in July, purchases of homes are still down significantly compared with 2018.

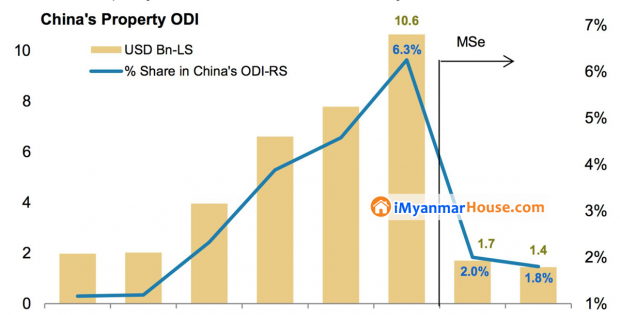

But while analysts typically blame high prices and growing worries about a possible recession, another factor is also playing a prominent role: Foreign buyers, particularly the Chinese, have pulled back sharply from the U.S. real estate market.

Foreign investors purchased $77.9 billion in residential property in the 12 months ending in March, down 36% from the previous 12-month period, the National Association of Realtors said in a recent report.

China, meanwhile, topped all other countries for the seventh consecutive year, with $13.4 billion in home purchases, but that was down a whopping 56% from the prior year, NAR said.

The next largest international buyers – Canada, India and the United Kingdom – also had big drops, but they represent smaller shares of the market.

“The magnitude of (China's) decline is quite striking, implying less confidence in owning a property in the U.S.,” says Lawrence Yun, chief economist of NAR.

All told, existing U.S. home sales are down about 3% so far this year from the same period in 2018 despite a 2.5% increase in July from the prior month, NAR figures show.

A big reason Chinese investors are retreating from the American housing market is that Beijing has placed tight limits on how much capital can leave the country in the wake of a devaluation in the yuan a few years ago.

“In China, each family member has been restricted to $50,000 or less,” says Steven Ho, senior loan officer at Quontic, a New York City-based bank.

That makes it tougher for Chinese investors to elbow out American buyers with all-cash offers. “A few years before, these restrictions were not so stringent.” The government toughened capital controls last year as the Chinese economy weakened, Ho says.

Ref: Property Report