Foreign Property News | Posted by Zarni Kyaw

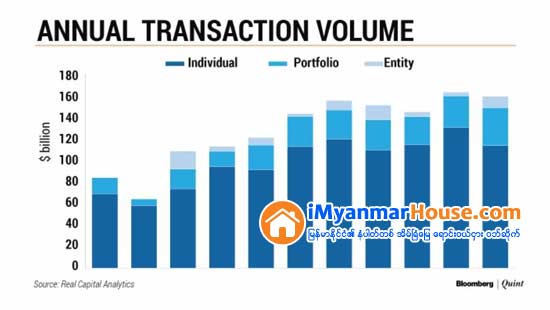

Investments in commercial properties in India hit a record high last year on increased appetite of global investors to own real estate in the world’s fastest growing economy.

“Overseas buyers represented 60 percent of India’s real estate deal total in 2018, well above the regional average, signaling that the country is increasingly becoming part of the global institutional real estate investment universe,” Petra Blazkova, senior director of Asia-Pacific analytics, at Real Capital Analytics, said in a report.

Upcoming initial share sales of distinctive real estate investment trusts “could indicate the market is embarking on the next evolutionary steps in real estate investment products”, Blazkova said.

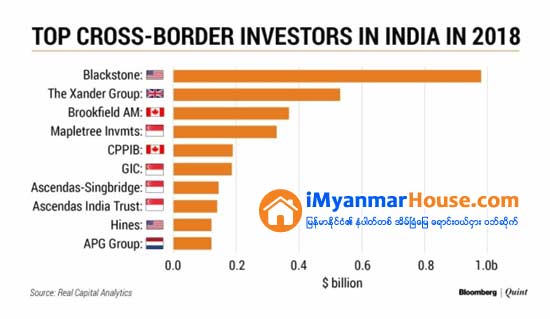

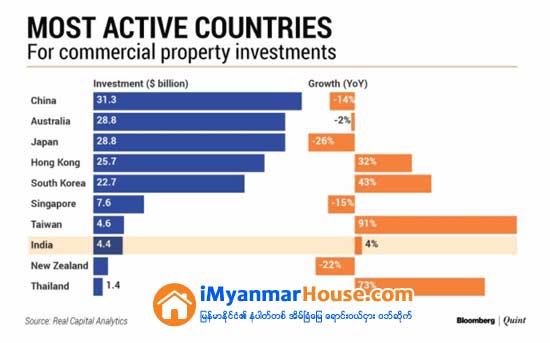

Investment in commercial properties in India rose 4 percent year-on-year to an all-time high of $4.4 billion in 2018, with cross-border investors expanding their presence. “So far, global investors such as Blackstone, The Xander Group, Brookfeld AM and CPPIB as well as Asian buyers such as Mapletree Investments and GIC have been increasing their allocation to the market,” the report, titled ‘Asia Pacific Capital Trends’, said. “Besides Mumbai, Bengaluru and Chennai benefitted from the influx of the cross-border funds.”

Commercial property sales in Mumbai, the country’s financial capital, jumped seven-fold over the last year to $1.45 billion. That catapulted it to the 15th most active metropolitan city in India from 53rd in 2017. Even Bengaluru and Chennai reported strong growth. Sales in Chennai nearly tripled to $667 million, while in Bengaluru it nearly doubled to $738 million.

The most active metro for the commercial property market in Asia-Pacific was Hong Kong with sales worth $25.6 billion. Taiwan was the fastest growing country in commercial property sales with a 91 percent rise.

Development site sales in India rose 61 percent to $2.9 billion. Here too, Taiwan was the fastest growing at 87 percent.

Investment activity in China was at its slowest since 2015, while in Japan it declined to its lowest levels since the global financial crisis. South Korea, in contrast, saw a record investment activity.

Ref: Property Report